Investment Philosophy

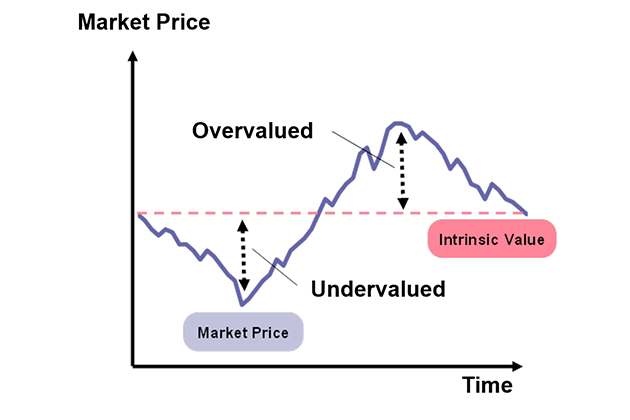

All securities have an intrinsic value - market price will converge with intrinsic value in medium/long term.

We define intrinsic value by an asset's future cash flows.

A stock's market value is not always similar to its intrinsic value - Market behaviour provides exploitable discrepancies between market price and intrinsic value. These present investment opportunities.

After purchasing a stock at an undervalued level, we wait for it to approach fair value – when intrinsic value and market vale are closely aligned. This is when we sell to capture alpha.

Our focus is on medium/long-term profitability - We are not swayed by short-term market movements.

Therefore our intrinsic value projections are based on medium/long-term forecasts and are stable.